The ABC's Of Recessions

In the past week, we have seen a lot of stories and information contending that the recession ended in July, including a lot of talk about U, V, and W shaped recessions. So what is a V shaped recession?

Recessions are typically defined simply as a period when GDP falls (negative real economic growth) for at least two quarters. Since this is measured by quarterly GDP numbers, many of the recessions are illustrated on graphs and charts. The shape of the GDP curves is used to describe the type and depth of the recession.

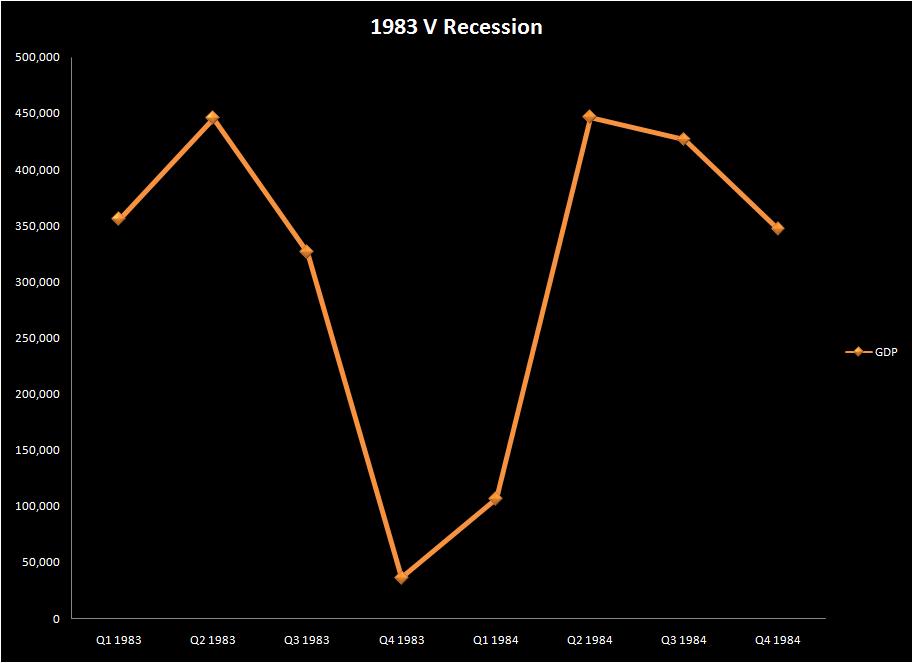

V Shaped Recession– sharp downturn followed by sharp recovery (1983)

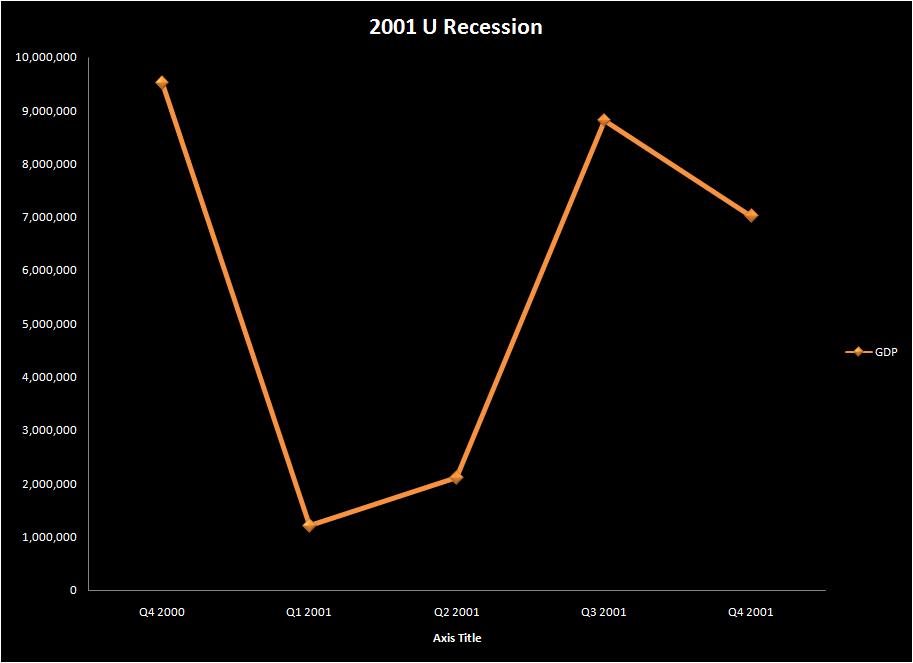

U Shaped Recession– typical downturn followed by recovery (1991, 2001)

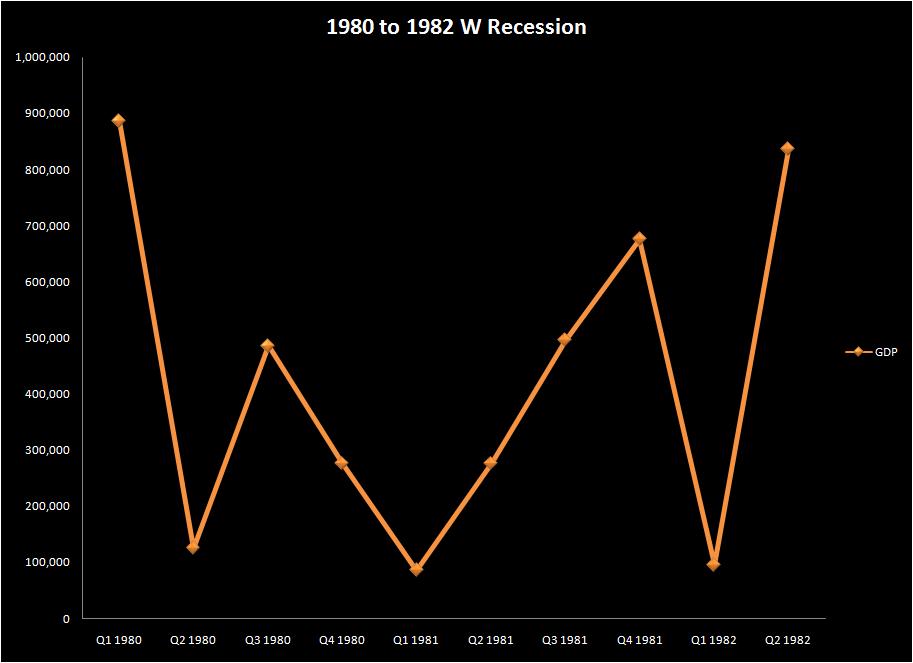

W Shaped Recession– short, severe recession followed by weak recovery, leading to another recession (1980, 1982)

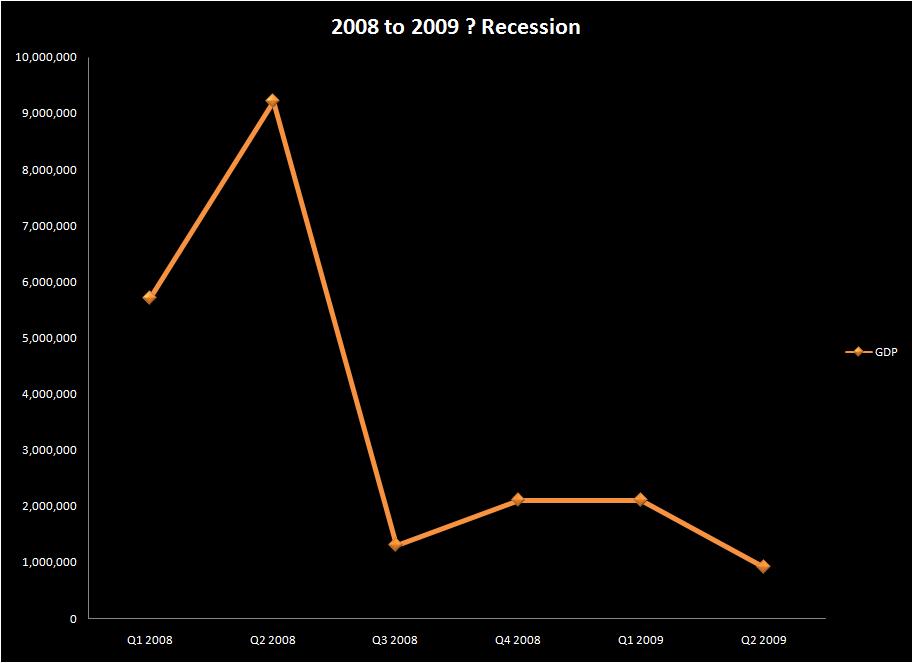

Current Recession (Long Extended Downturn)

I didn’t do graphs for them, but there are two other very important types of recessions

- Sideways L Recession– long downturn followed by recovery (Japan)

- Checkmark Recession- sharp downturn followed by gradual recovery

So what’s going to happen? Real growth is likely during the summer, but some of that will be at the expense of the fall (read Cash for Clunkers). In September, we will see a jump in the employment rate due to seasonal factors that will probably push the number up to the promised 10%.

So, yes conditions are getting better, but a relapse is quite possible and any chance of a V recovery are basically slim and none. My guess? A sideways to checkmark recovery is ahead. Should be an interesting and bumpy Q3 and Q4. When employment outside government and healthcare begins to improve, stronger growth will appear again.